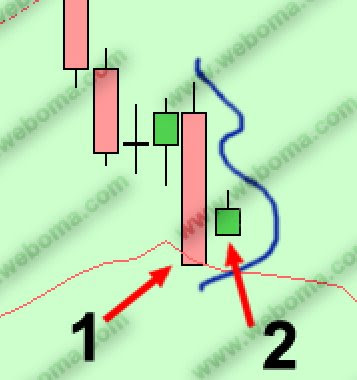

Harami means pregnant in Japanese. Harami pattern

is formed by two candlesticks. One big (the mother) and one small (the baby).

The bigger one covers the whole or at least the real body of the smaller one.

Harami can be seen both at the top of an uptrend or at the bottom of a

downtrend. The small candle can be formed any where along the length of the big

candle but the important thing is that it should be covered by the big

candlestick.

The more difference between the size of two

candlesticks, the more effective and potent the signal is.

Like the Dark Cloud

Cover, Piercing Line and Harami can work as reversal signals but they have to

be confirmed by the next candlesticks. These patterns can not be known as

reliable and strong reversal signals.

If you already have a

position and you have some profit in your hands, when you see any of the above

patterns, you have to close your trade or at least tighten your stop loss and

wait for the market to go ahead.

If it changes the

direction, you will be safe because you already collected your profit or your

stop loss will protect your profit and if it keeps on moving to the same

direction, you will make more profit.

When the small

candlestick in Harami pattern is a Doji, the pattern is called Harami

Cross. A long body candlestick followed by a Doji which is covered by the

long candlestick should not be ignored at all: